What is a Short-Term Rental?

A Short-Term Rental, also known as a vacation rental, is the rental of a legally licensed dwelling unit for periods of less than 30 consecutive days. A Short-Term Rental License is required prior to advertising and renting your property.

Who needs to apply for a Short-Term Rental License?

Any owner renting a property for a period of thirty (30) days or less is required to apply for a Short-Term Rental Permit. It is the owner(s) responsibility to know and comply with all ordinances, resolutions and regulations that apply to short term rentals within the City of Chattahoochee Hills.

What if I do not obtain a Short-Term Rental License?

Renting or advertising your home for rent on a short-term basis without a license is in violation of the City of Chattahoochee Hills's ordinances and subject to penalties as provided for in Chapter 10, Businesses, Article XIII, Short-Term Rental Regulations, Section 10-367, Violations.

What is the Hotel/Motel Tax?

This is a tax on your gross short-term rents. In some cases, these are paid by an intermediary (Airbnb, etc). Hotels also pay this tax. This rent includes all consideration received for occupancy including all non-optional fees (other than taxes) such as booking/reservation fees; cleaning fees; pet charges; fees for extra vehicles, people or beds; etc.

When is the Hotel/Motel Tax due?

Hotel/Motel Tax payments are due no later than the 15th of the following month. If there was no rental activity for the previous month, you are still required to submit the completed Tax form.

How is penalty and interest calculated on late payments?

When paid timely, the licensee may deduct and retain three percent (3% )of the first $3,000 of the tax collected and ½% of the amount in excess of $3,000 as a vendor's credit. For failure to pay by the due date, the licensee not only loses vendor's credit, but it subject to paying a penalty and interest on the tax due. The penalty is 10% of the amount due and interest of one percent (1%) per month or fraction thereof that the tax is delinquent.

Do I also need to obtain a Business License?

Yes. A Business License is a required part of the STR License application.

What is the cost of an STR License?

There is an annual fee of $100. This does not include your Business License application fees.

Does my short-term rental license apply to multiple properties?

No. Each property requires its own STR License.

Do I have to display my license?

Yes. The STR License and visitor emergency information must all be posted in a conspicuous place within the short-term rental unit at all times. Your STR License PDF can be found in the Business Center by clicking your account name under "Manage Your Account(s)".

Is the City working with Airbnb?

Yes. Airbnb (as well as Egencia, Expedia, and Homeaway) does collect and remit Hotel/Motel taxes to the City of Chattahoochee Hills on behalf of property owners and/or authorized agents. However, this is not guaranteed to be happening, or happening correctly, for your rental. As such, it is your responsibility to keep track of all taxes remitted by Airbnb and ensure you are paying the correct amount.

Is the City working with Vrbo?

Vrbo currently is NOT remitting Hotel/Motel taxes to the City.

How many people can stay in my short-term rental?

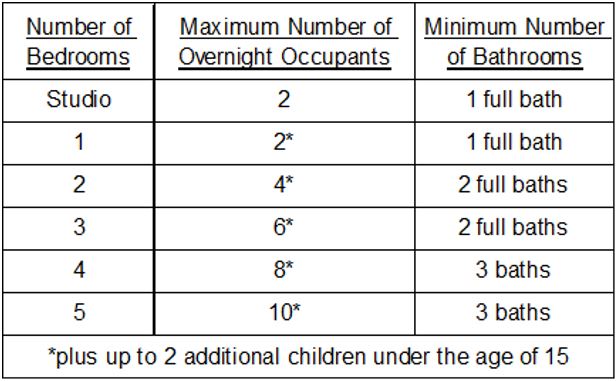

The maximum allowable overnight occupancy for each short-term rental dwelling unit shall be calculated on the basis of two (2) persons per bedroom. Please see the chart below.

Can I pay by credit card?

Yes! We are able to Mastercard, Visa & Discover.

Can I pay by e-check (ACH Debit)?

Not at this time.

How do I amend a return?

Please email Chattahoochee Hills at

Dana.wicher@chatthillsga.us letting them know you need to file an amended return. In the email please include:

1)Your six digit license/account number, and owner name

2) Period you need to amend (i.e. Q1 2021 form due April 30th)

3) If you overpaid or underpaid your original form

4) Brief explanation as to why the form needs to be amended

Once we receive this email we will review your account and send you further instructions.

I need to close my account. What do I do?

Please email the city Chattahoochee Hills at

Dana.wicher@chatthillsga.us and

nathan.mai-lombardo@chatthillsga.us and Please include the closure date, account number, and the reason you are closing the account.

What types of assistance can MUNIRevs provide to me?

MUNIRevs can assist you with all your system questions. Whether you have a question about your account or technical questions about how to do something in MUNIRevs, please reach out to our support team.. You can reach MUNIRevs at

blt.str.support@govos.com and by phone at (888) 751-1911.

Where are my tax forms? My Action Center is empty.

Your tax forms will be available on the 1st day of the month following the last day of the tax period. For example, the March tax forms will be available in your Action Center on April 1. If you do not see the forms you expected, simply contact MUNIRevs support for assistance.

Can I manage multiple properties with one login?

Yes - to do so, click Add accounts from your user login under Manage Your Account(s). You will need your 6 digit Account Number and the LODGINGRevs Activation Code to connect to an existing property record.

Can a property have more than one user?

Yes, each property can have an unlimited number of users. Each user is required to provide the 6 digit Account Number and the LODGINGRevs Activation code to be authorized to connect to an existing property record.

I did not receive or I misplaced the letter with my activation code. What do I do?

Contact MUNIRevs

blt.str.support@govos.com or by phone at (888) 751-1911 for assistance. You will need to confirm account details to be verified for the account. To protect the security on property accounts, you will need written (e-mail) permission from a registered owner or officer of the property for us to provide you with a new activation code.

Can I file a Zero File tax return through MUNIRevs?

To file a zero file tax form, select your tax form from your Action Center. Then, complete the required information on the remittance, including Gross Rents and any deductions. You will be prompted to confirm your desire to complete the return as a Zero File return.

What payment types are accepted by the City through MUNIRevs?

The City accepts major credit cards.

Can I schedule a payment in MUNIRevs?

For your security, MUNIRevs does not store any payment information in the system. You will need to enter your desired payment information each time you check out.

How do I change the User on a Property?

All users need to register, just as you did, by going to the home page for that jurisdiction (i.e. https://chatthills.munirevs.com). They will click on the "Go" button under "New Users". They will also need the 6 digit account number and Activation Code for the property.

I forgot my password. What do I do?

From the Log In page, click the "Forgot your password" link and follow the instructions that will be e-mailed to the User's registered e-mail address.

Do I have to login to MUNIRevs to see my alerts and reminders?

No. All alerts are e-mailed to your authenticated e-mail address. When you login to the system, you will also see any open alerts that need to be addressed in your Action Center.

For Assistance, Contact

MUNIRevs Support

(888) 751-1911

When contacting support, be sure to include the jurisdiction (Chatt Hills) and your account number in all emails or voicemails. This will help us assist you as promptly as possible. Thanks!